India – U.K. Free Trade Agreement

India and the United Kingdom have signed the Comprehensive Economic and Trade Agreement (CETA), a bilateral free trade agreement marking a major milestone in their longstanding partnership. The agreement was signed by Commerce and Industry Minister of India and UK Secretary of State for Business and Trade in the presence of Prime Minister of India and UK Prime Minister. This follows the successful conclusion of negotiations announced on May 6, 2025, and reflects the shared ambition of two major economies to deepen economic ties. Bilateral trade has already reached USD 56 billion, with a target to double this by 2030.

Currently, the India – UK trade is at

- India-UK bilateral annual trade ~USD 56 billion

- Total merchandise-trade ~ USD 23 billion

- Total services trade ~ USD 33 billion

CETA provides an unprecedented duty-free access to 99 per cent of India’s exports to the UK, covering nearly 100% of the trade value.

This includes labour-intensive sectors such as textiles, leather, marine products, gems and jewellery, and toys as well as high-growth sectors like engineering goods, chemicals, and auto components.

This will spur large-scale employment generation, empowering artisans, women-led enterprises, and MSMEs.

The agreement includes a wide-ranging package covering Information Technology /IT enabled services, financial and professional services, business consulting, education, telecom, architecture, and engineering that will unlock high-value opportunities and job creation.

The agreement goes beyond goods and addresses services, a core strength of India’s economy. India exported over USD 19.8 billion in services to the UK in 2023, and CETA promises to expand this further In a first by UK, mobility for professionals across IT, healthcare, finance, and education is being eased with CETA providing for streamlined entry for Contractual Service Suppliers, Business Visitors, Intra-Corporate Transferees, Independent Professionals. Another major breakthrough is the Double Contribution Convention that will save Indian firms and workers more than INR 4,000 crore by removing the need for dual social security contributions.

The India–UK Comprehensive Economic and Trade Agreement (CETA) is designed to open new avenues for trade and investment, while protecting India’s core economic interests. It combines tariff reduction, simpler rules for trade, strong provisions for services, and measures that make professional mobility easier.

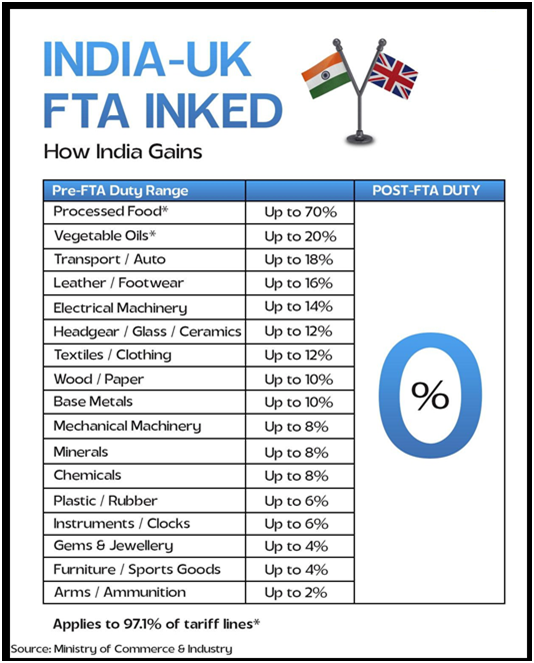

Comprehensive Tariff Elimination

CETA ensures tariff elimination on about 99 per cent of tariff lines, covering India’s nearly entire trade basket. This means nearly 100 percent of Indian goods such as textiles, leather, marine products, gems and jewellery, toys, chemicals, engineering products, chemicals, agri- products will enter the UK market at zero duty.

At the same time, India has opened 89.5 % of its tariff lines covering 91 % of UK’s export. Only 24.5 % of UK’s export will enjoy immediate duty free market access. India has safeguarded sensitive sectors like dairy, cereal, millets, pulses, certain essential oils, apples, certain vegetables, gold, jewellery, lab grown diamonds. Strategic exclusions also cover critical energy, fuels, marine vessels, some polymers, worn clothing, smart phones, optic fibres . For strategically important products where domestic capacity is being built, for example under Make in India or PLI, India will provide gradual tariff reduction over 5, 7 or 10 years. India has gradually and selectively opened her markets to alcoholic beverages.

Bilateral safeguards have been built in to manage any sudden import surges that could harm domestic industries.

Simplified Rules of Origin

The agreement simplifies compliance by allowing exporters to self-certify the origin of products, reducing time and paperwork. UK importers can also rely on importers’ knowledge for certification, further easing trade. For small consignments under £1,000, there is no requirement for origin documentation, which supports e-commerce and small businesses. Product Specific Rules of Origin (PSRs) align with India’s current supply chains for key sectors such as textiles, machinery, pharmaceuticals, and processed food.

Boost for Services and Professional Mobility

Services are a core strength of India’s economy, and the agreement provides deeper market access across IT, financial services, education, and healthcare. It also creates a structured framework for the temporary movement of professionals. Business visitors, contractual service suppliers, and independent professionals can now access the UK under clear and predictable entry rules. Additionally, up to 1,800 Indian chefs, yoga instructors, and classical musicians can work in the UK every year under these provisions.

Double Contribution Convention

A key innovation in the agreement is the Double Contribution Convention (DCC). This exempts Indian workers and their employers from paying UK social security contributions for up to three years when on temporary assignments. Around 75,000 workers and over 900 companies are expected to benefit, resulting in savings of more than INR 4,000 crore.

Wishing you the very best to export to United Kingdom.