GST 2.0: A Game-Changer for India’s Importer and Exporter.

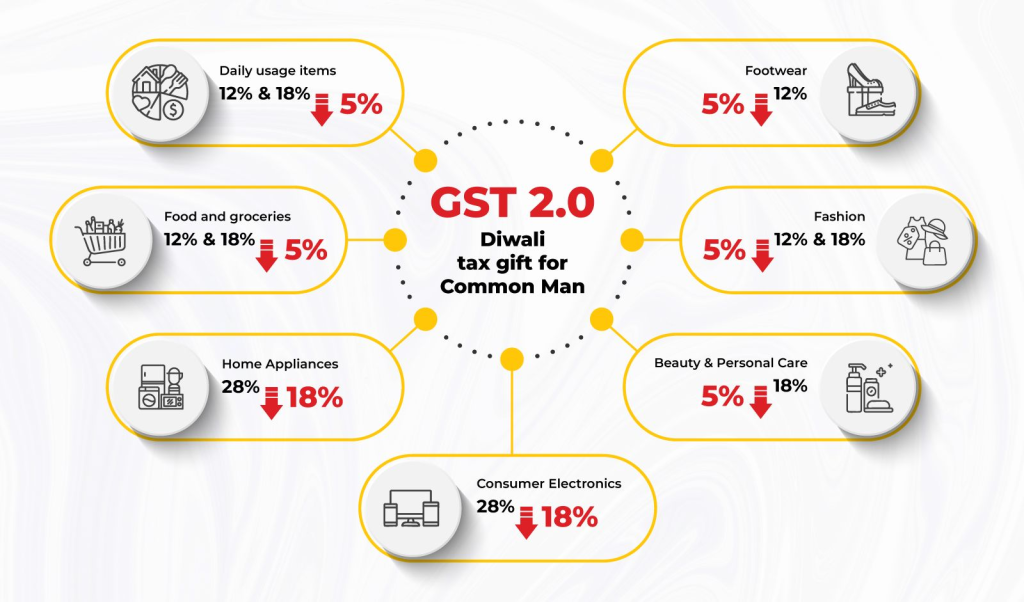

On September 22, 2025, India ushered in a transformative phase of its Goods and Services Tax (GST) system—dubbed GST 2.0—just in time for the festive season. This comprehensive overhaul aims to simplify the tax structure, reduce prices, and stimulate consumer spending across the nation.

-

Exporters: A Boost in Competitiveness

- Zero-rated Supplies Remain Unchanged, But Simpler Filing

- Exports are considered zero-rated supplies under GST. GST 2.0 maintains this, ensuring that exporters do not pay GST on exports, while retaining the ability to claim input tax credits (ITC) on domestic purchases.

- Filing has become simpler and faster, reducing compliance burden and increasing efficiency in export operations.

- Reduced GST Rates on Inputs

- Many raw materials and intermediate goods now fall under lower GST slabs (5% or exempt).

- This reduction in input costs improves the profit margin for exporters, making Indian goods more competitive globally.

- Enhanced Cash Flow

- Streamlined GST refund processes for exporters ensure faster reimbursement of GST paid on inputs, addressing a long-standing concern about working capital delays.

- Stimulated Domestic Demand

- With GST 2.0 reducing consumer prices, domestic demand may rise. For exporters who also sell domestically, higher domestic sales can stabilize production volumes and costs, indirectly benefiting export operations.

- Importers: Simplification & Cost Management

- Reduced GST on Imported Goods

- Goods imported into India that attract lower GST rates under the new structure reduce overall landed cost for importers.

- Items like electronics, auto parts, and raw materials now face lower GST rates, helping reduce input costs for manufacturing and resale.

- Streamlined Compliance

- GST 2.0 integrates better with Customs and import documentation, reducing errors and delays in filing GST on imported goods.

- This ensures smoother clearance at ports and avoids penalties or interest due to GST calculation errors.

- Improved Cash Flow

- With clearer GST rules and faster input credit claims, importers can offset GST paid on imports against GST on domestic sales, improving working capital efficiency.

- Trade Facilitation & Market Sentiment

-

- Boost for Manufacturing and Export-Oriented Units: Lower taxes on machinery, electronics, and raw materials reduce production costs.

- Encouragement for SMEs and Startups: Simplified GST 2.0 compliance lowers administrative costs for small exporters and importers.

- Positive Market Sentiment: Investors and businesses perceive GST 2.0 as a pro-business reform, leading to potential increase in investments in export-oriented sectors.

- Strategic Considerations for Businesses

-

- Exporters should consider increasing export volumes to capitalize on cash flow benefits and improved cost competitiveness.

- Importers can explore bulk import strategies for essential raw materials and components to benefit from reduced GST rates.

- Both exporters and importers can revisit pricing and contracts with overseas partners to reflect lower input costs and faster supply chain efficiency.

Conclusion

GST 2.0 represents a win-win for India’s international trade ecosystem.

For exporters, it reduces costs, streamlines compliance, and enhances competitiveness.

For importers, it lowers GST on inputs, simplifies filing, and improves cash flow.