What is Marine Insurance

Marine Insurance protects exporters, importers, and logistics operators against financial loss or damage to cargo during transit, whether the movement is domestic or international.

Marine insurance covers goods in transit — international OR domestic.

Why Marine Insurance is important in Export Import business?

In international trade, goods face many risks:

- Damage due to rough handling

- Loss of cargo at sea

- Fire, explosion

- Theft or pilferage

- Vessel sinking or collision

- Natural calamities (storm, cyclone, flood)

- Container falling overboard

Without insurance, the entire loss is borne by a single party, either the exporter or importer.

Marine insurance protects the party at risk — not the party paying the premium.

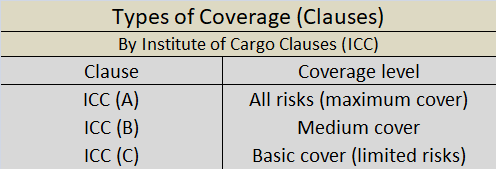

Types of Marine Insurance

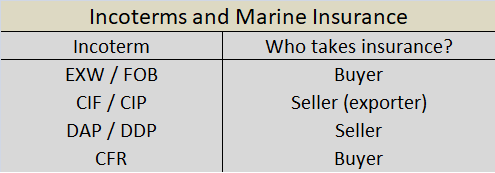

Incoterms and Who claims

What is the Incoterm and Who claims the insurance?

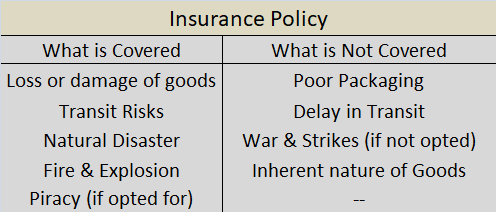

Marine Insurance Policy

What is covered under this type of Insurance and what is not covered

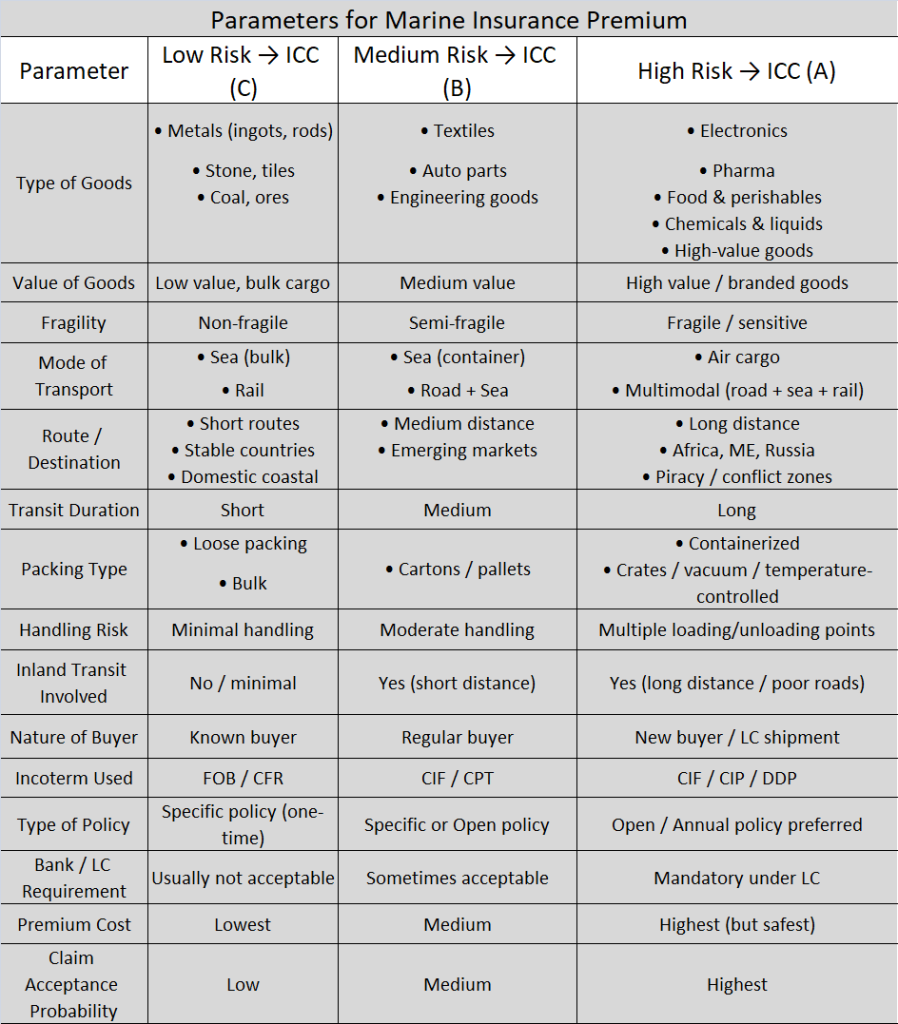

Below we give a detailed understanding of various Parameters involved in the calculation of Premium for Marine Insurance

Avoid the following Mistakes to Save Premium

- Insuring only invoice value

- Taking ICC (C) to save premium

- Missing inland transit cover

- Wrong company name

- Delay in claim intimation

- Back-dated insurance

- Currency difference – Insurance Currency should match Invoice currency

Marine insurance protects the party at risk — not the party paying the premium.