Customs Duty

Customs Duty is an indirect tax imposed by the government on goods when they are transported across international borders. It is a tool used not just for collecting money, but for shaping a country’s economic landscape.

Why is Customs Duty Levied?

The government applies these taxes for four main strategic reasons:

- Protection of Local Industry: By making imported products more expensive, the government ensures that “Made in India” products remain competitive.

- Revenue Generation: It is a major source of income for the government, helping fund infrastructure like roads, hospitals, and schools.

- Regulating Trade: It helps control the inflow of restricted or prohibited items (like hazardous chemicals or weapons).

- Anti-Dumping: It prevents foreign companies from “dumping” excess stock in India at unfairly low prices that could kill local businesses.

When is Customs Duty Applicable?

An importer pays Customs Duty during arrival (of products, goods, cargo) in India

Customs duty is triggered at a specific moment known as the “Taxable Event.”

- Import Duty: Applicable the moment goods enter Indian territorial waters and are filed for “Home Consumption” or “Warehousing.”

- Export Duty: Applicable on a few specific items (like certain types of leather or minerals) when they leave the country to ensure domestic supply stays stable.

- Personal Baggage: If you are traveling from abroad, any items exceeding the “Free Allowance” limit are subject to customs duty at the airport.

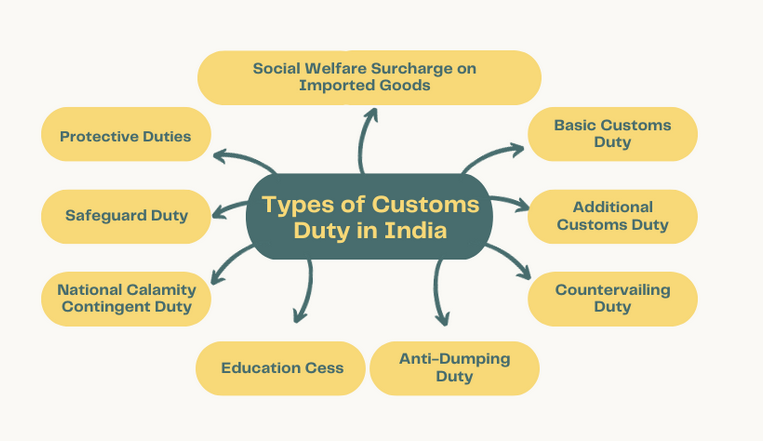

Core Components of Customs Duty in India:

In India, the core components of customs duty typically include the following elements:

- Basic Customs Duty (BCD): This is the primary tax imposed on imported goods, calculated based on the goods’ value (assessable value) and their classification under the Harmonized System (HS) code.

- Integrated Goods and Services Tax (IGST): Under the GST regime, IGST is levied on the import of goods and replaces older duties like Additional Customs Duty (CVD) and Special Additional Duty (SAD). It is applied to the sum of the assessable value plus the BCD and any other duties.

- Social Welfare Surcharge (SWS): This is a surcharge generally calculated at 10% of the aggregate of customs duties (specifically on the BCD amount) to fund social welfare programs.

- Anti-Dumping Duty (ADD): This may be imposed on imported goods that are being sold at prices below their normal market value in the country of origin, which can harm domestic industries.

- Safeguard Duty: A temporary duty applied when there is a sudden and unforeseen surge in imports of a particular product that threatens to seriously injure a domestic industry.

- Protective Duty: This duty is imposed to protect specific nascent or sensitive domestic industries from foreign competition.

- GST Compensation Cess: Applicable on certain specified goods like luxury items and “demerit” goods (e.g., tobacco, cars) to compensate states for potential revenue losses due to the implementation of GST.

- National Calamity Contingent Duty (NCCD):A duty levied on specific goods to generate funds for national disasters or emergencies.

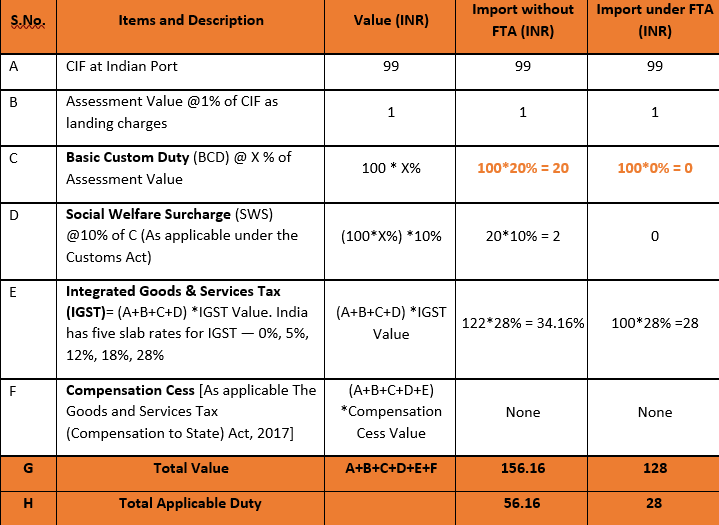

Example of the Customs Duty Calculation

We give an example with Free Trade Agreement and without any Trade Agreement.

Most of the Customs Duty Components are also used in the below example: