India’s ongoing effort to internationalize the Indian Rupee (INR) reflects a strategic shift towards strengthening its global economic footprint and reducing dependence on foreign currencies such as the U.S. Dollar.

The Reserve Bank of India (RBI), through initiatives like the introduction of Special Rupee Vostro Accounts (SRVAs), has enabled partner countries to settle bilateral trade directly in INR.

The rationale behind this move is to:

- Promote greater use of the Rupee in global trade,

- Conserve foreign exchange reserves,

- Mitigate currency risks arising from dollar volatility, and

- Enhance India’s financial sovereignty.

For exporters, this transition offers several advantages:

- It simplifies trade settlements,

- Reduces transaction and

- Conversion costs,

- Shields against exchange rate fluctuations, and

- Opens opportunities in markets facing dollar liquidity issues.

Ultimately, the internationalization of INR not only benefits Indian exporters but also positions India as a more resilient and self-reliant participant in the global trading system.

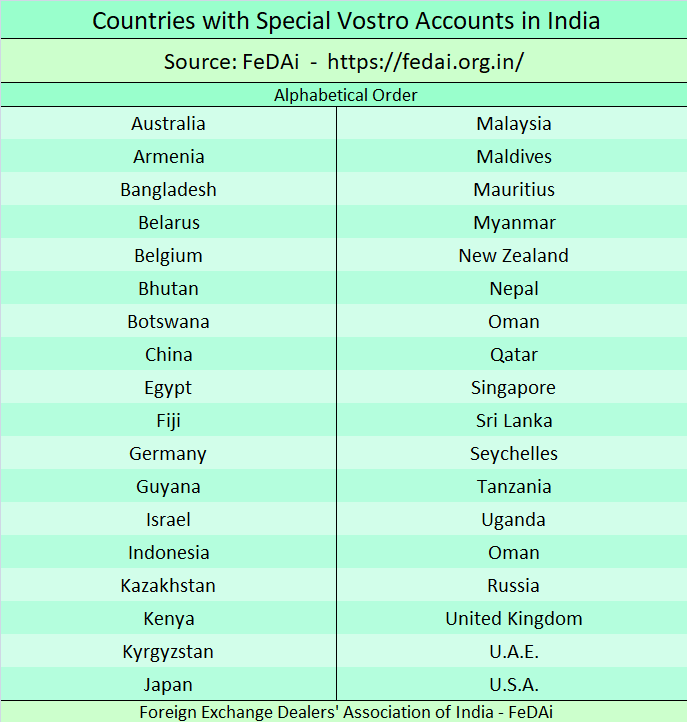

Here we present a list of countries that have agreed to trade with India in INR.

Process for Trade Settlement in INR

As an exporter follow the below process:

- Preliminary Checks

- Confirm that the buyer’s country has an SRVA arrangement with an Indian AD (Authorized Dealer) Bank.

- Obtain the name of the foreign bank holding the SRVA in India.

- Verify the Indian AD Bank’s SRVA details (available on www.fedai.org.in).

- Ensure that the buyer agrees to invoice and settle in INR.

2. Contract & Documentation

- Prepare a sales contract/invoice denominated in Indian Rupees (INR).

- Mention “Settlement through SRVA mechanism under RBI Circular A.P. (DIR Series) No.10 dated July 11, 2022.” (for example)

- Include agreed conversion rate clause (as per RBI or market rate on date of settlement).

- Obtain all necessary export documents:

- Commercial Invoice (INR-based)

- Packing List

- Shipping Bill / Bill of Lading / Airway Bill

- Certificate of Origin

- Insurance Certificate

- Quality/Inspection Certificates

- Banking & Payment Process

- Inform your Indian AD Bank in advance that payment will come via SRVA route.

- The foreign importer’s bank will debit their local currency account and credit INR equivalent to their SRVA account in India.

- Indian AD Bank will credit the exporter’s INR account once the SRVA is funded.

- Obtain Bank Realization Certificate (BRC) after payment credit.

- RBI & FEMA Compliance

- Ensure Shipping Bill mentions INR settlement in the currency field.

- File EDPMS data with INR value and SRVA route.

- Maintain proper documentation for FEMA audit trail.

- Practical Tips

- Check daily exchange reference rate to align pricing.

- Keep close contact with bank’s foreign exchange department for SRVA updates.

- Monitor RBI/FEDAI circulars for newly added SRVA countries.

- Keep copies of all SWIFT/payment messages for proof of settlement.

Important Note:

- Check with the FeDAi website for the Country’s Special Rupee Vostro Account (SRVA).

- Check with the corresponding bank in Buyer’s country and in India.

Thank you