What is Customs Clearance?

Customs Clearance is the legal process through which goods are allowed to enter or leave a country after verification by Customs authorities that all laws, duties, documents, and compliances are fulfilled.

In simple words:

Customs Clearance = Government permission to import or export goods.

Customs Check document–HS code–value–policy

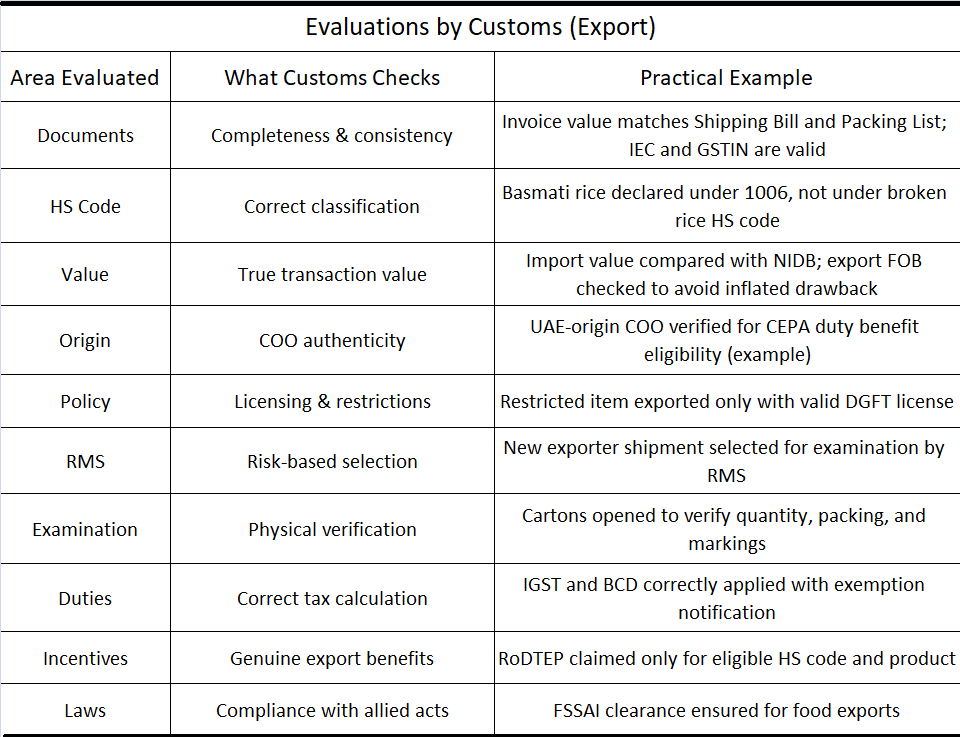

Customs ensures four core objectives:

- 1. Correct declaration

2 Correct duty/tax payment

3 Policy & regulatory compliance

4 Trade security & risk control

Customs Clearance – Step-by-Step (India)

For Exports

- Shipping Bill filed on ICEGATE

- Documents verified

- RMS assessment

- Examination (if selected)

- Compliance certificates verified

- LEO – Let Export Order granted

Only after LEO the goods can be exported.

For Imports

-

Bill of Entry filed

-

Assessment of classification & value

-

Duty calculation

-

RMS / examination (if selected)

-

Duty payment

-

Out of Charge (OOC) given

Only after OOC can goods be taken delivery.

Who Performs Customs Clearance?

- Customs Officers (Government)

- Customs Broker (CHA) on behalf of importer/exporter

- Self-filing exporters/importers (where permitted)

Why Customs Clearance is Important?

- Prevents smuggling & fraud

- Ensures government revenue

- Protects consumers & environment

- Maintains international trade trust

Important:

Without Customs Clearance your products can not be exported or imported.

Customs Clearance = Government permission to import or export goods.