Understanding Marine Insurance

Marine Insurance is a risk protection mechanism in export–import trade that covers loss or damage to goods during transit by sea, air, or land.

It safeguards exporters, importers, and banks against financial loss arising from accidents, theft, fire, or natural calamities.

The coverage operates in line with the transit and risk transfer defined under Incoterms.

Marine insurance ensures continuity of international trade by converting uncertain transit risks into manageable costs.

Despite the name “marine,” it covers sea, air, rail, and road transport—basically, whenever cargo is moving from the seller to the buyer.

Marine Insurance protects exporters, importers, and logistics operators against financial loss or damage to cargo during transit, whether the movement is domestic or international.

In export Import, marine insurance is from warehouse to warehouse. Marine Insurance is covered from Seller’s warehouse or factory till buyer’s warehouse or factory.

Importance of Marine Insurance

In international trade, goods face many risks:

- Damage due to rough handling

- Loss of cargo at sea

- Fire, explosion

- Theft or pilferage

- Vessel sinking or collision

- Natural calamities (storm, cyclone, flood)

- Container falling overboard

Without insurance, the entire loss is borne by the exporter or importer.

Marine Insurance Policy premium is calculated

Understanding parameters which affect the Insurance Premium

- Nature of Goods

Example: Machinery would be at low premium whereas perishable goods would be a higher premium

- Type of Coverage

Example: “A” type of coverage will have higher premium, “B” medium and “C” low.

- Mode of Transport

Example: Sea transport will fetch low premium against multimodal or land transport

- Route and Destination

Example: Regions like Russia, Middle East etc. where there could be a war, a piracy prone region or a congested or risky port etc., will fetch higher premiums

- Packing Quality

Example: Containerized Cargo will be safer and fumigated palletization will be at lower premium

- Past Claims, if any will bear higher premium

Example: any history of insurance claim in the past will get a higher premium

- Type of Policy

Example: Annual Policy will be at lower premium

- Additional Coverage

Example: for war, theft, strikes, riots etc. will invite additional premium

Marine Insurance and its co-relation with Incoterms

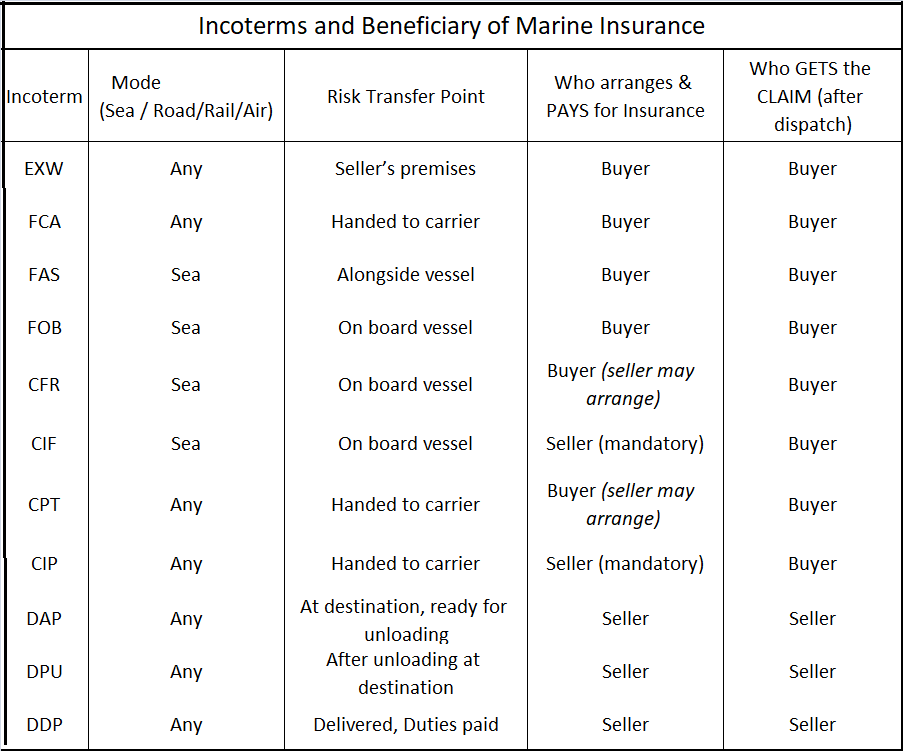

- Incoterms define the point at which risk transfers from seller to buyer, not ownership of goods.

- Marine insurance follows this risk transfer point, meaning the party bearing the risk at the time of loss is entitled to the insurance claim.

- Who pays for insurance and who receives the claim can be different, especially under CIF and CIP.

- Therefore, exporters must align Incoterms, insurance coverage, and contract terms carefully to avoid claim disputes.

Below table explains who will pay and who will take the claim in Marine Insurance – whether the buyer or the seller.